The best contributing stocks during the month were Heijmans, flatexDEGIRO, and Palomar Group. Those with the weakest performance during the month were Everus Construction, Redox, and Rev Group.

February is an intense month on the reporting front, and the largest movements in stocks during the month can certainly be attributed to whether the companies' reports met or fell short of market expectations. Heijmans, our Dutch construction company, beat market forecast across all measures for 2024 in principle and issued guidance for a consistently solid market of high demand, meaning it can be selective in which projects it chooses to bid on. Given a solid order book and ongoing margin improvements, the company should expand its earnings per share by more than 30% in 2025. Despite the share price having risen by more than 150% in the past year, it still trades at a low P/E of 7x. At the other end of the scale is our US installation firm Everus Construction. What was seemingly a convincing report was not taken as such by the market. Turnover and profits expanded by around 20% in the quarter, and the order book was in line with Q3, growing almost 40% on a yearly basis. The market, however, directed its focus on the sequentially weaker order intake, with book-to-bill dropping from just 2x in Q3 to less than 1x in Q4. Whether this is a natural quarterly fluctuation, owing to some larger data center orders booked in Q3 rather than Q4, or a new trend of declining order intake remains unclear. What is obvious is that the market's negative sentiment regarding investments in data centers was the foremost interpretation, and the share price fell steeply in the wake of the report.

Key market events and trends (what has influenced performance most?)

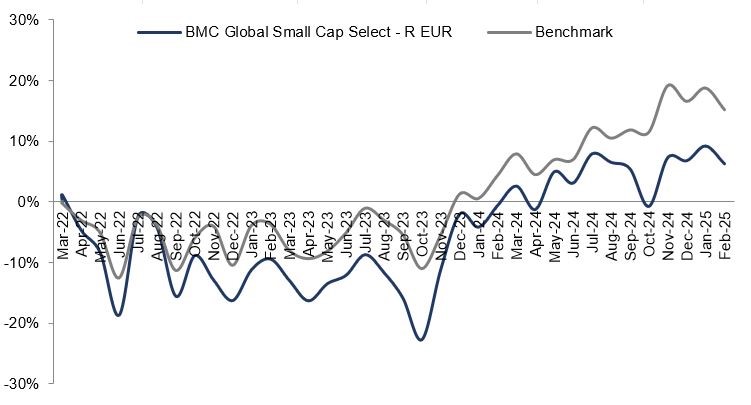

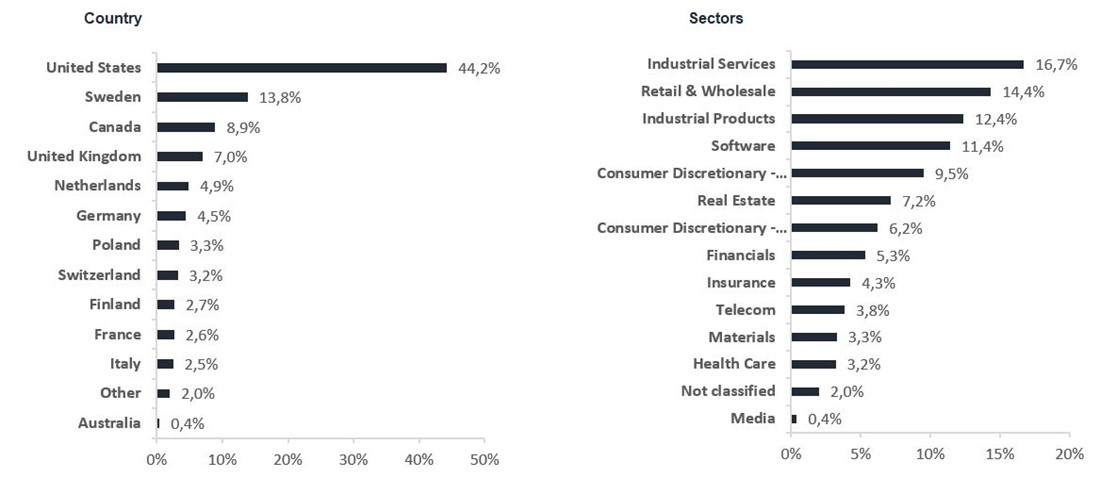

Like January, February was another turbulent month, with profound swings on the world's stock markets. Political rhetoric was blended with generally good year-end reports for 2024. What has become clear is the growing uncertainty among companies and investors alike. Companies state that tariffs are affecting activity to a certain extent and, in general, they are more careful when the conditions can change like this in a heartbeat. And investor sentiment can turn on a dime as the geopolitical playing field shifts. It is too early to judge the effects of this on the real economy and individual companies, but so far, we have seen a tendency towards investors reducing their US exposure and upping their exposure to Europe. And if the promised efforts towards general rearmament in Europe do materialize, it will prompt major defense spending, infrastructure investments, and an expansion of industrial capacity. When events occur that bring turbulence and uncertainty to the markets, it often also creates opportunities that we, as active investors, can utilize. Sometimes these are small occurrences, and other times they are massive events birthing interesting new trends, and we are ready to leverage any of the investment opportunities that might emerge. We maintain the fund's relatively underweight exposure to the US, and we have invested in reasonably valued companies driven by secular trends in Europe.

Portfolio changes

During February, we bought GXO Logistics and sold Lyko and Elmos Semiconductor. GXO Logistics is the world's largest pure contract logistics company. The company is no real estate firm; it doesn't own any of the properties itself, instead renting premises and staff, and automating the locations according to customer needs. After seeing a couple of years of diminishing customer volumes, GXO reported volume growth once more in Q4, although at a low level. It has also signed many new contracts that will contribute to future growth.

The fund's positioning—our market expectations

We hold a solid global small cap portfolio of what we consider the world's best entrepreneur-driven companies, our Champions, in fields such as industrials, retail trade, software, logistics, construction materials, and insurance. We also invest in an exciting collection of Special Situations at relatively low valuations with the aim of selling higher. Given their appealing valuation, both relative to larger companies and in absolute terms, small caps are, in our view, an asset class positioned for relatively strong returns.

**MSCI ACWI Small Cap NTR $ in EUR