The best contributors during the month were Fortnox, ICICI Bank, and HCA Healthcare. Those that showed the weakest contribution during March were ASM, Saint-Gobain, and Atlas Copco. Generally speaking, the stocks that have not been affected by the ongoing political debacle in the US performed well, while cyclical stocks for which there is a risk that the spectacle can impact underlying demand and earnings growth had a more challenging month. Fortnox—the portfolio holding providing the best contribution to the fund's performance in March—was the subject of a takeover bid on the last day of the month, when the company's largest owner, Olof Hallrup, together with EQT submitted a bid at a some 40% premium to the previous trading day's closing price. We own almost 1% of Fortnox and it does sting to have to say goodbye to the company, which is the epitome of a Champion, with its dominant position in a niche market, robust pricing power, high customer growth, scalable cost base, stellar cash conversion, solid balance sheet, and more. Of course, freeing up some cash in these turbulent times is a comfort, and we can invest this in other holdings that we find to be trading at appealing valuations

Key market events and trends (what has influenced performance most?)

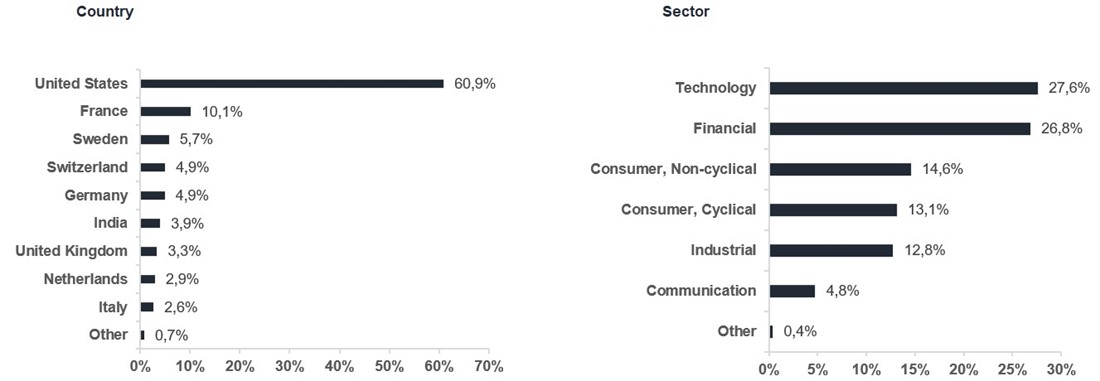

According to Chinese astrology, 2025 is the year of the snake, a time for transformation (think: shedding the skin) and we find it hard to see a more fitting phrase than this to describe what is going on right now. The world is changing, and so is our fund, as we increase our weighting in Europe and reduce the share in the US.

Both political opinions and real-life events affected the stock markets during the month and, although the underlying sentiment has been negative, there are also many companies that will benefit as the playing field is redrawn. Some general observations from our many company visits in recent weeks:

- The uncertainty regarding tariffs seems the greatest in the US, where there is a virtual standstill on the investment front right now. Previously decided investments are not being halted but are postponed. Activity is likely to pick up again as soon as companies have a new game plan to follow.

- How tariffs will play out is hard to judge. Companies hope to be able to push cost increases down the supply chain. In the end, someone needs to pay, and this can impact demand, which, in its turn, can affect companies' price adjustment capacity. We already know that some of our holdings, such as Ferrari, are likely to be relatively unaffected in 2025. A US insurance company like Progressive and a hospital company such as HCA will also come through this relatively unscathed in the longer term, and we find it hard to believe that global consumption in the use of Google or Microsoft's products will decrease dramatically. US brands like Nike can be affected though, but we have already scaled back our position here to an absolute minimum.

- There is burgeoning optimism about increased industrial and construction activity in Europe. Large fiscal initiatives focused on general modernization will provide support for many years to come. And certain companies are already experiencing rising business demand, even if we need to wait a couple of quarters to see concrete orders.

In the fund now, we are laying much of our focus on investing in non-US stocks.

Portfolio changes

We have no new changes to holdings to report. During the month, we markedly decreased our weighting in Nike.

The fund's positioning—our market expectations

We have a healthy global portfolio of what we consider to be the world's finest companies, our Champions, in sectors like industrials, retail, tech, logistics, construction materials, and insurance. We also have our exciting collection of Special Situations, which we invest in at relatively low valuations and aim to sell at higher values. Our investment in Veolia is a prime example of a stock in which we anticipate significant upside in the next 12–18 months.

*MSCI All Country World NTR $ in EUR

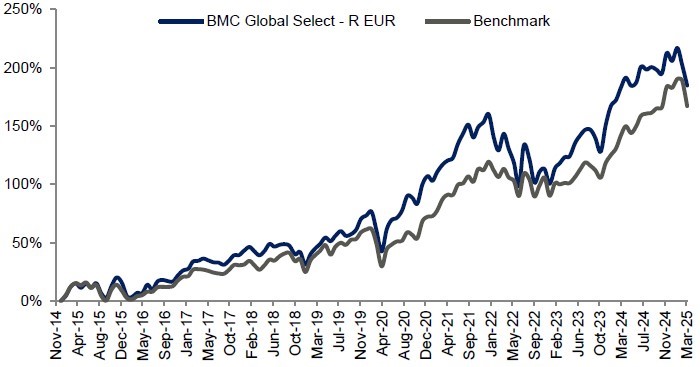

| 1 mth | YTD | 5 years | Since inception |

BMC Global Select - R EUR

| -5,96%

| -6,89%

| 99,68%

| 184,71%

|

Benchmark

| -7,64%

| -5,55%

| 105,66%

| 167,06%

|