Herman Ohlsson

Analyst with a focus on the semiconductor industry, Brock Milton Capital AB

Please note:

Past performance is not a guarantee of future returns. The value of shares in the fund may go up or down, and an investor may not get back the amount originally invested

Blog & Media

Blog | 24 maj 2024

The message from the company’s most recent report was clear. Demand continues to grow, hyper-scalers continue to invest in data centers, and the new chips are ever more advanced. Nvidia surpassed the high expectations for the fourth time in a row and Jensen Huang, founder and CEO, was dressed in his usual uniform of black jeans and leather jacket as he explained, “we don’t do GPUs, we build AI systems.”

The innovation is hard to deny in a company that many associate with designing the best GPUs. In recent times, development has been unimaginably fast, and Nvidia not only makes individual chips but also entire systems of multiple interconnected GPUs that allow for easy, scalable, and rapid implementation of AI by its customers.

Nvidia is a fantastic example of one of our fund’s Champions; its market position is dominant and its innovation is so exceptionally strong that it is almost competing against itself, with every chip launched being 2–3 times better than its predecessor. We have owned Nvidia since 2019 and the company forms a stellar example of what we look for in our Champions. In this blog post, I cover yesterday’s report, what drives demand, and how Nvidia can become the world’s third-largest company after Microsoft and Apple, with a breathtaking market cap of USD 2.5tn.

Nvidia—from graphics to AI

Before taking a deeper dive into yesterday’s report, I will first answer one quick question: how did Nvidia get where it is today? Many know the company in its current incarnation, but few know these foundations were laid when it was established back in 1993. Nvidia doesn’t simply design GPUs; it invented them. The company thus created its own market, one that didn’t previously exist, and today it still dominates. The GPU market is currently valued at in excess of USD 100bn a year, more than 90% of which is controlled by its inventor. Nvidia’s initial market was graphics for gaming, where the ability of a GPU to process data in parallel proved beneficial for handling the large amounts of data that graphics craved. This enabled several other markets, such as cloud and AI, which would not have been possible without GPUs. That ChatGPT could even be created and trained with vast amounts of data depends on Nvidia’s powerful GPUs.

Fourth report in a row to exceed expectations

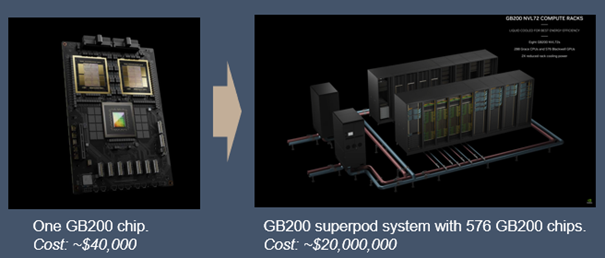

Expectations were, as usual, high ahead of yesterday’s report. Owing to Nvidia’s solid weight as part of the S&P500, which has now surpassed 5%, the market is on tenterhooks before every one of its reports. But, just as with previous reports over the past year, it once again beat expectations—now for the fourth time in a row. Turnover for data centers came in at USD 22.6bn, versus expectations of USD 21.1bn. The company offered guidance for ongoing growth in the next quarter too, with data centers expected to bring in nearly USD 24bn. In addition, it also stated that its new chip, Blackwell, will be supply constrained into 2025. This suggests demand outstripping supply, which the market viewed positively and which also improves visibility for next year. A Blackwell chip is rumored to cost around USD 40,000 a piece, which would be 30% more expensive than its predecessor, Hopper, released last year. Two factors play into Nvidia being able to raise prices this significantly: its chips becoming more powerful and able to process more data per KW, and the competition being currently very low.

Image. Nvidia’s new chip, GB200, is expected to be launched during Q4. GB200 super-pod is a system with 576 interconnected GPUs that act as one large GPU. Source: Nvidia.

Image. Nvidia’s new chip, GB200, is expected to be launched during Q4. GB200 super-pod is a system with 576 interconnected GPUs that act as one large GPU. Source: Nvidia.

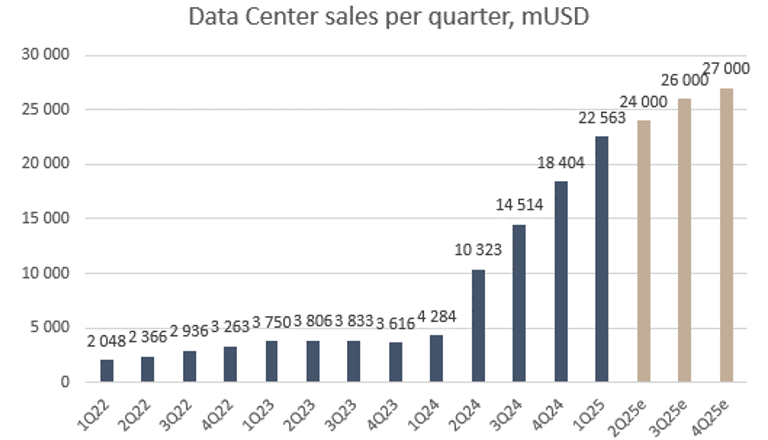

The graph below shows how data centers gathered pace a year ago and have since continued to grow strongly each quarter—something expected in the coming quarters as well. During 2022, Nvidia reported turnover of just over USD 27bn for the year, and it is now expected to report this each quarter going ahead. It is easy to see why the share price has shot up by more than 600% since then.

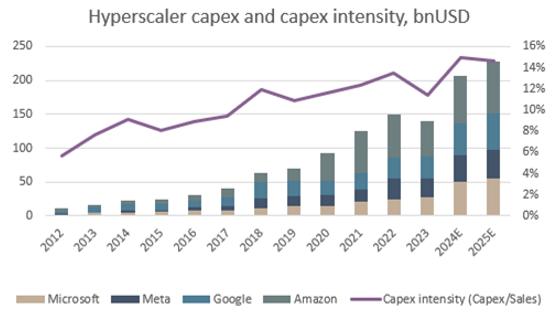

The key reason for its solid growth is that customers—hyper-scalers in the US, most of all—have increased their investments (capex) in data centers by an average of 25% a year over the past ten years. This outstrips their turnover, which has expanded by 18% over the same period. This means that the intensity has increased and a larger share of turnover than before is now assigned to these investments. Ten years ago, they were expending about 4% of their turnover on such investments, while today this figure is closer to 12%. These investments primarily consist of constructing and equipping data centers to be able to provide cloud solutions, and now AI initiatives, favoring Nvidia considerably. During Q1, the hyper-scalers accounted for “just” 40% of turnover, having been at closer to 100% for many consecutive quarters, as they were early adopters of the newest GPUs to scale up their AI initiatives. This is particularly positive as the remaining 60% comes from enterprise—everything from vehicle manufacturers and banks to software companies, which are now also investing heavily in their own GPUs to drive AI. In this way, Nvidia is diversifying its customer base and reducing its dependency on those four US hyper-scalers. This also shows that AI is a widespread phenomenon among companies wanting to boost their productivity through increased sales and lower costs.

The key reason for its solid growth is that customers—hyper-scalers in the US, most of all—have increased their investments (capex) in data centers by an average of 25% a year over the past ten years. This outstrips their turnover, which has expanded by 18% over the same period. This means that the intensity has increased and a larger share of turnover than before is now assigned to these investments. Ten years ago, they were expending about 4% of their turnover on such investments, while today this figure is closer to 12%. These investments primarily consist of constructing and equipping data centers to be able to provide cloud solutions, and now AI initiatives, favoring Nvidia considerably. During Q1, the hyper-scalers accounted for “just” 40% of turnover, having been at closer to 100% for many consecutive quarters, as they were early adopters of the newest GPUs to scale up their AI initiatives. This is particularly positive as the remaining 60% comes from enterprise—everything from vehicle manufacturers and banks to software companies, which are now also investing heavily in their own GPUs to drive AI. In this way, Nvidia is diversifying its customer base and reducing its dependency on those four US hyper-scalers. This also shows that AI is a widespread phenomenon among companies wanting to boost their productivity through increased sales and lower costs.

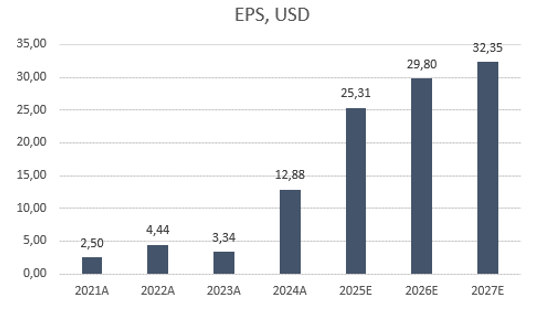

This expansion has led profit growth to skyrocket, as can be seen in the graph below of expected profit growth per share. During 2024, profits quadrupled and can be expected to double again next year.

This expansion has led profit growth to skyrocket, as can be seen in the graph below of expected profit growth per share. During 2024, profits quadrupled and can be expected to double again next year.

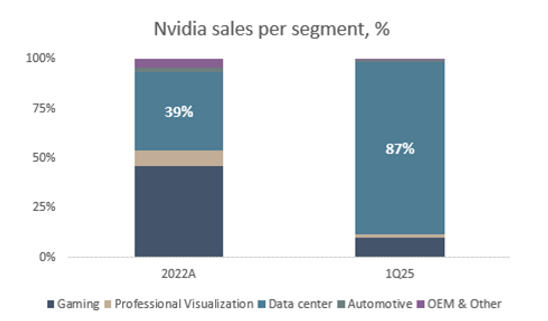

The formidable growth in data centers has also spurred this to become Nvidia’s largest segment, accounting for 87% of turnover in the most recent quarter. Just two years ago, it represented 39%. Everything else that Nvidia is doing right now is overshadowed by its data center business, despite it having a particularly exciting platform for self-driving vehicles, which is set to pick up speed in the coming years.

The formidable growth in data centers has also spurred this to become Nvidia’s largest segment, accounting for 87% of turnover in the most recent quarter. Just two years ago, it represented 39%. Everything else that Nvidia is doing right now is overshadowed by its data center business, despite it having a particularly exciting platform for self-driving vehicles, which is set to pick up speed in the coming years.

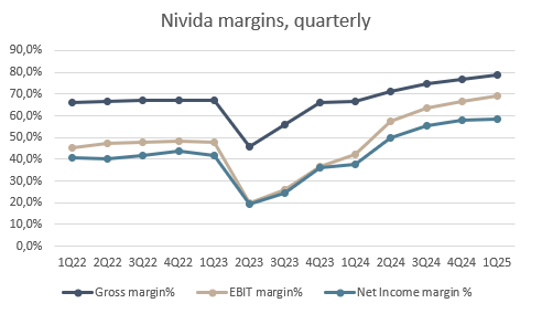

Owing to the solid performance of the data centers segment, margins have risen substantially, as these chips hold a higher margin than the equivalents used in gaming, for example. This has propelled Nvidia’s net income margin from 40% to 60% in the most recent quarter. This in turn means that more than half of Nvidia’s turnover is profit—a clear demonstration of the robust pricing power it holds and the value that its GPUs create for customers.

Owing to the solid performance of the data centers segment, margins have risen substantially, as these chips hold a higher margin than the equivalents used in gaming, for example. This has propelled Nvidia’s net income margin from 40% to 60% in the most recent quarter. This in turn means that more than half of Nvidia’s turnover is profit—a clear demonstration of the robust pricing power it holds and the value that its GPUs create for customers.

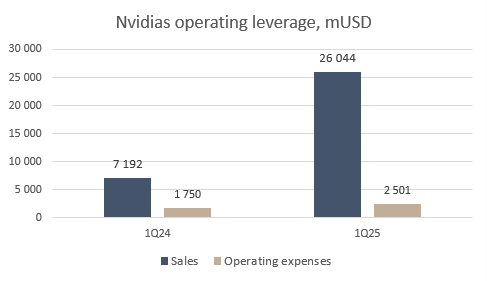

Most fascinating about Nvidia, and something that delights an equity analyst, is its operational leverage. As Nvidia doesn’t produce the chips itself—outsourcing their production to TSMC, having designed them (with the help of Cadence and Synopsys)—it takes very little capital to increase its turnover. The graph below illustrates this, showing why its margins can increase so decisively. This quarter, Nvidia improved its turnover by USD 18bn (from USD 7bn last year to USD 26bn), while costs only rose by a scant USD 800m. This is leverage rarely seen even among the very best software companies and it explains how scalable Nvidia’s business model is.

Most fascinating about Nvidia, and something that delights an equity analyst, is its operational leverage. As Nvidia doesn’t produce the chips itself—outsourcing their production to TSMC, having designed them (with the help of Cadence and Synopsys)—it takes very little capital to increase its turnover. The graph below illustrates this, showing why its margins can increase so decisively. This quarter, Nvidia improved its turnover by USD 18bn (from USD 7bn last year to USD 26bn), while costs only rose by a scant USD 800m. This is leverage rarely seen even among the very best software companies and it explains how scalable Nvidia’s business model is.

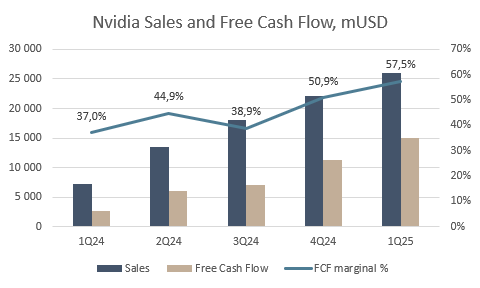

The elevated margins also provide fantastic cash flow for Nvidia that it can spend on share buybacks and increasing dividends. During the most recent quarter, the company hit a record-high free cash flow of USD 15bn and thus a massive free cash flow margin of 57.5%. This means a majority of its turnover is converted into cash flow. Generally speaking, a cash flow margin above 30% is considered incredibly strong—and Nvidia’s is almost double that.

The elevated margins also provide fantastic cash flow for Nvidia that it can spend on share buybacks and increasing dividends. During the most recent quarter, the company hit a record-high free cash flow of USD 15bn and thus a massive free cash flow margin of 57.5%. This means a majority of its turnover is converted into cash flow. Generally speaking, a cash flow margin above 30% is considered incredibly strong—and Nvidia’s is almost double that.

We have said countless times before that Nvidia is a Champion, but I hope this blog post provides a deeper understanding of this company, what we like best about it, and why it has long been a holding in BMC Global Select and will long remain so too.

We have said countless times before that Nvidia is a Champion, but I hope this blog post provides a deeper understanding of this company, what we like best about it, and why it has long been a holding in BMC Global Select and will long remain so too.

Sources for images and text: Nvidia, Bloomberg, Brock Milton Capital’s analysis and estimates.

Blog | 12 mar 2025

Blog | 24 maj 2024

Blog | 15 mar 2024

This website is using cookiesfor statistics and user experience

This website uses cookies to improve your user experience, to provide a basis for improvement and further development of the website and to be able to direct more relevant offers to you.

Feel free to read ours privacy policy. If you agree to our use, choose Accept all. If you want to change your choice afterwards, you will find that option at the bottom of the page.