L’Oréal has been a holding in our Global Select fund for many years, proving a fantastic contributor to its returns. In fact, L’Oréal is one of the longest-standing holdings in our fund. The company recently published its latest quarterly results and, as usual, this was a stable and decent report.

L’Oréal’s successful model

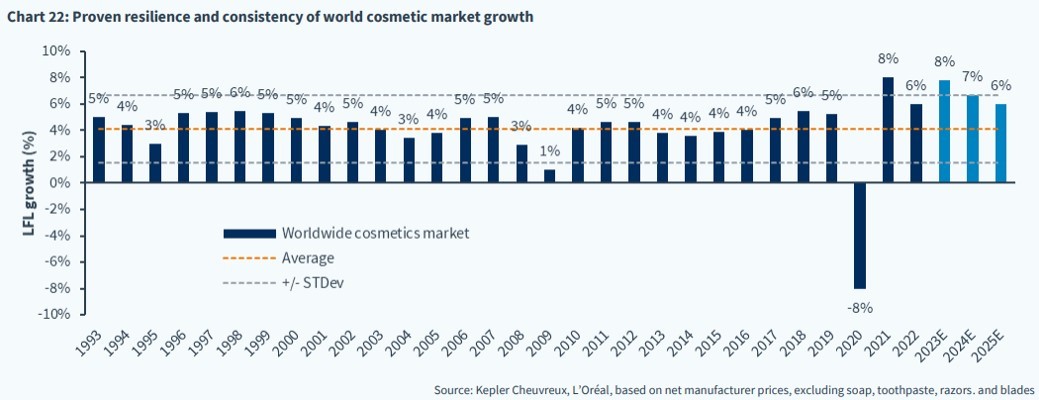

From a holistic perspective, the investment case is relatively simple. Good quality, stable organic growth (high single digits), consistently improving margins, and investments in free cash flow to acquire compelling brands. As seen in the graph below [1], cosmetics is an attractive sector to operate in, growing consistently and stably over time.

As the market leader in the cosmetics sector, L’Oréal grows by 1–2% more than the market annually, meaning it continuously reinforces its position. In addition to its robust market position, L’Oréal has its own venture capital branch. The CEO of this business is Laurent Schmitt, who we had the pleasure of speaking with during our company visit. As new brands emerge in the cosmetics sector, L’Oréal buys into them through its VC business, with the option of acquiring the whole company later on should it perform as it wishes. The opportunity to integrate these companies into the L’Oréal organization and utilize the fantastic distribution and manufacturing has been a huge advantage for many years. The company has simply turned a number of clear potential rivals into a separate revenue stream.

Ongoing margin improvements

L’Oréal’s high, stable, and enduring profit growth has rewarded the company with a solid position, in turn offering economies of scale in production and the possibility of investing in R&D and marketing. This is something the company does year in and year out, thus increasing its profits even more. What a virtuous circle.

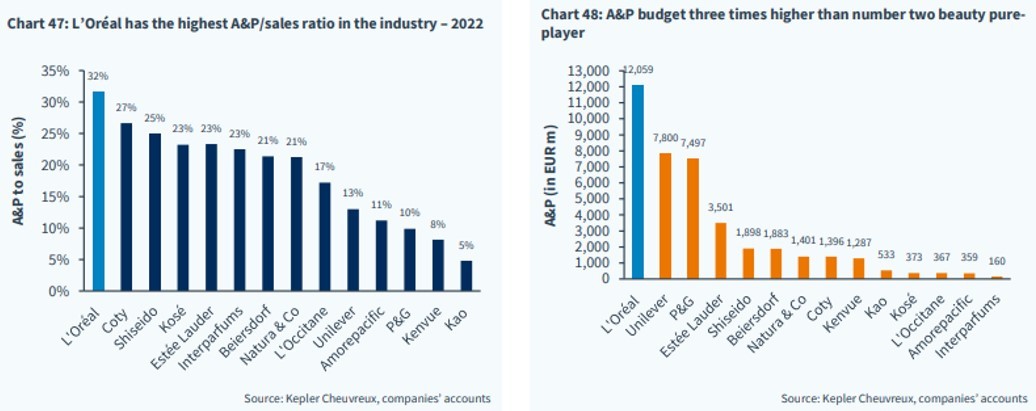

This has provided L’Oréal with what is, in principle, an unrivaled position from which it can spend three times more on marketing than its closest competitor. L’Oréal is de facto the market player spending the highest percentage of its turnover on marketing. Given that the company is the largest player on the market, it quickly becomes clear that we are talking about enormous sums that its competitors simply cannot match. If a competitor cannot match the sector number one, it becomes particularly difficult to close the gap to that player.

Note that A&P = marketing cost.[1]

Note that A&P = marketing cost.[1]

One might believe that initiatives to strengthen a market position and keep competitors at bay would take a toll on margins. Not true. L’Oréal has consistently improved its margins, and today they are at almost 20%—it is best in class here, too. In addition, it has propelled e-commerce in the sector (now the key sales channel) and is at the forefront in terms of cosmetics innovation.

Sustainability lies in the company’s DNA

In recent years, sustainability has come into focus, with many companies taking up the fight against climate change and for increased equality and better company governance. There are also companies that have long worked with this, even before it became popular and compulsory in certain countries. L’Oréal has focused on sustainability for many, many years, and it was one of the first companies to sign the UN Global Compact, back in 2003. For eight years in a row, it has been ranked as among the 1% best companies for its ESG work. A solid undertaking by this cosmetics giant.

L’Oréal is a real Champion

It was clear during our visit that L’Oréal has many underlying driving forces working in its favor. Examples are the aging population and the economic improvements for the populations in emerging markets. Two completely different factors that both increase demand for L’Oréal’s products.

Stable profit growth, excellent margins, great cash flow, a rock-solid market position, and genuine ESG work. All this spells a real Champion that we have owned for many years and that has provided a healthy contribution to the fund’s returns, and most of all to our unitholders.

[1]https://research.keplercheuvreux.com/be/kepler-file/document?file=EQ360_1040785.pdf&id=43cce74e-560c-11ed-bd0b-0050568f8cb8