Our two best contributors during February were the US insurers Progressive and Arthur Gallagher, which did not report any sizable losses from the horrific fires in California. On the contrary, the two both showed solid profit growth. On the weaker side of the equation were Google, Martin Marietta, and building and construction firm Everus Construction. What was seemingly a convincing report was not taken as such by the market. Turnover and profits expanded by around 20% in the quarter, and the order book was in line with Q3, growing almost 40% on a yearly basis. The market, however, directed its focus on the sequentially weaker order intake, with book-to-bill dropping from just 2x in Q3 to less than 1x in Q4. Whether this is a natural quarterly fluctuation, owing to some larger data center orders booked in Q3 rather than Q4, or a new trend of declining order intake remains unclear. What is obvious is that the market's negative sentiment regarding investments in data centers was the foremost interpretation, and the share price fell steeply in the wake of the report.

Key market events and trends (what has influenced performance most?)

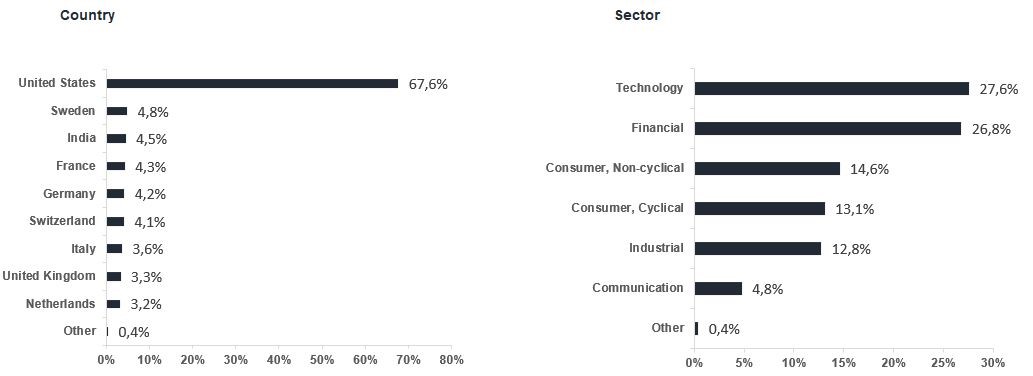

Like January, February was another turbulent month, with profound swings on the world's stock markets. Political rhetoric was blended with generally good year-end reports for 2024, and almost all our companies reported in with or better than expected. As we wrote in last month's newsletter, we will focus on the growth opportunities that emerge with these geopolitical fluctuations and try to earn money for our unitholders through the various swings as they take place. In recent weeks, it has been increasingly clear that one of the winners in the coming years will be European shares—something that excites us since this is our home turf. We have moved a share of our capital to European companies recently and, as of the end of February, the fund now has a 28% exposure to Europe. At the time of writing, we have increased this significantly more.

Portfolio changes

During February, we finished buying Germany's SAP (a Champion), and in early March, we also took positions in France's Saint-Gobain and Veolia. At the CES trade show in Las Vegas in January, we learned that those with the best data will get the most from AI, which sets SAP on an extremely solid footing for the coming years. Increasing investments in Europe should certainly push overlooked shares like Saint-Gobain and Veolia to higher profit growth, as well as more elevated valuations than they have seen in recent years. In Veolia, we see 40% upside in the coming 12–18 months. To finance these new holdings, we took decent profits in US software company Servicenow and also sold our smaller positions in Synopsys and Medpace.

The fund's positioning—our market expectations

Our global portfolio is a convincing of blend of fantastic Champions that we own for the long term, alongside an exciting group of Special Situations, in which we invest at relatively low valuations and aim to sell higher. These include new holdings Saint-Gobain and Veolia. In anticipation of strong investment cycles in both the US and now also Europe, we consider our fund well-positioned for 2025 and beyond.

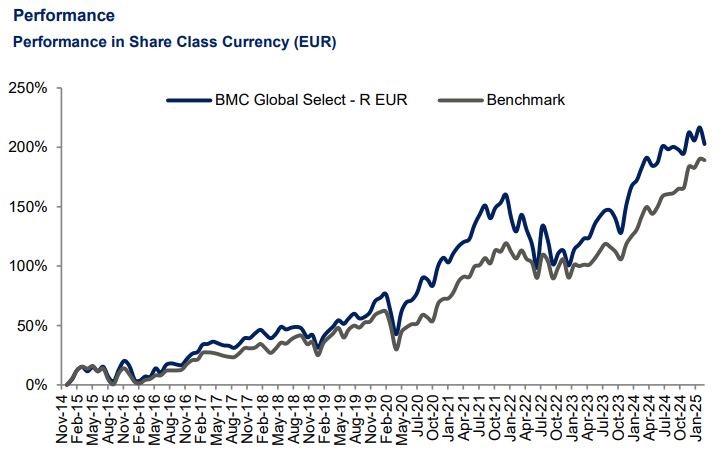

* MSCI All Country World NTR $ in EUR

| 1 mth | YTD | 5 years | Since Inception |

BMC Global Select - R EUR

| -4,43%

| -0,99%

| 87,62%

| 202,75%

|

Benchmark (EUR)

| -0,38%

| 2,26%

| 93,13%

| 189,14%

|